Discover GoComply

The Intelligent AMLA Compliance Platform

Know Your Customer

Also known as KYC which addresses the Customer Risk Profiling and onboarding processes with multi-risk factors.

Watch List Management

Comply with regulations by Fuzzy Logic Engine customer screening against all the selected sanction lists and (PEP LIST).

Customer Due Diligence

Based on Customer, Product / Services, Geolocation and payment channels risk factor to auto conduct the CDD Processes.

Suspicious Transaction

Based on the Suspicious Transaction Monitoring Parameters/ Rules Policies to track and monitor any suspicious transactions.

Case Management

System to generate the cases to provides full end-to-end and holistic oversight enabled Compliance Officer to rapid follow up of suspicious cases within a single repository.

Auto Generate Compliance Reports

Auto generate the BNM AMLA Compliance Reports such as STR Reports, CDD Reports, Annual DCR Report.

Events

Latest News

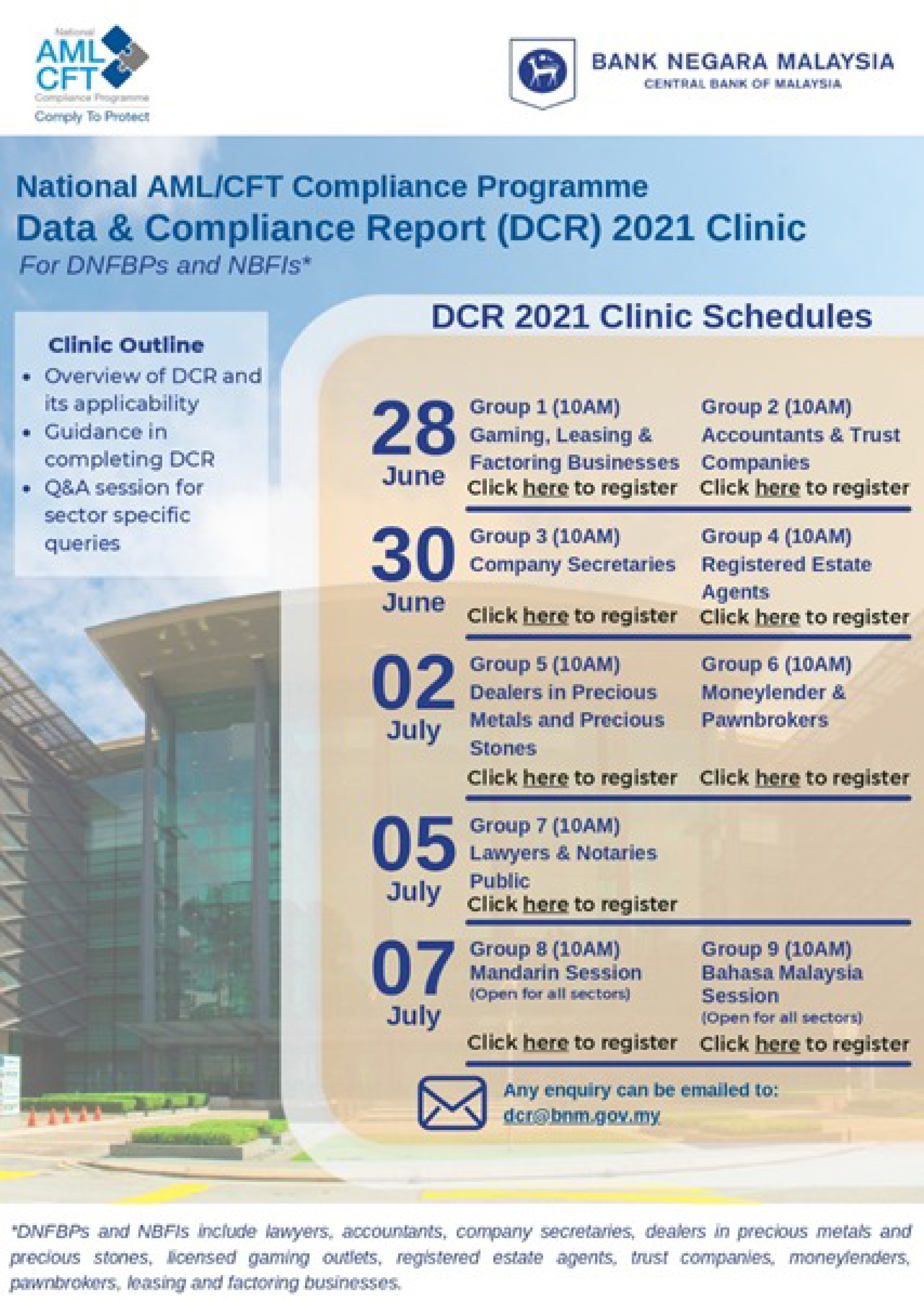

June 2021 DCR Clinic Schedule

Bank Negara Malaysia (BNM) has on 17 June 2021 issued AML/CFT Newsletter 3/2021 relating to the issuance of AML/CFT Data & Compliance Report (DCR) 2021 to DNFBP and NBFI reporting institutions (RIs).

The DCR 2021 submission through an online portal is accessible beginning 16 June till 31 August 2021.

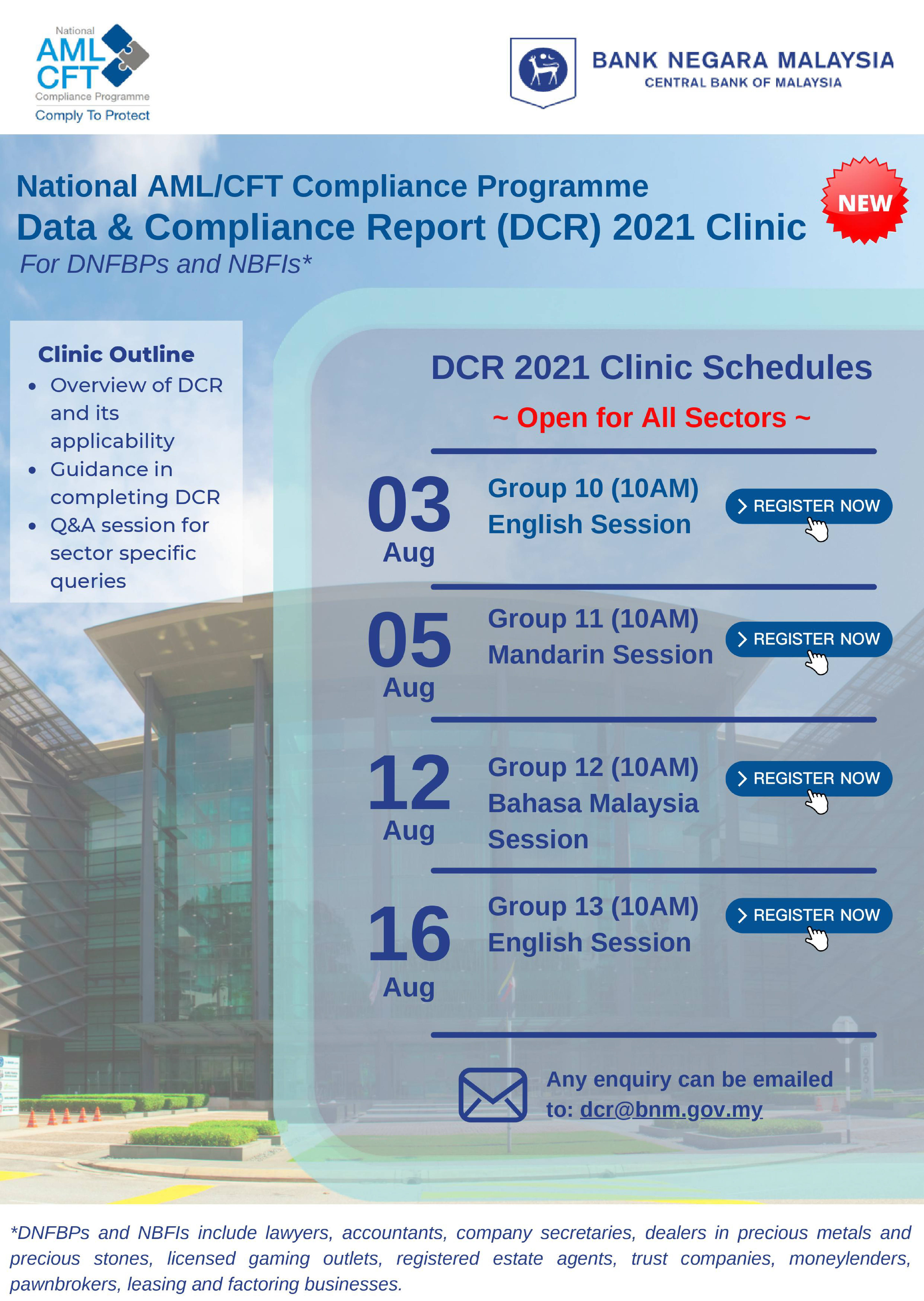

Aug 2021 DCR Clinic Schedule

Bank Negara Malaysia recognises that the Movement Control Order (MCO) 3.0 which began on 1 June 2021 may have some impact to reporting institutions�? day-to-day operations and accessibility to records/database.

Given the possibility of extended MCO, BNM organize another DCR workshop on Aug and all the reporting institutions are given flexibility to respond to the DCR 2021.

Keep us informed should there be any challenge in responding to DCR 2021.

Measurable Success

Product Excellence Is Our Goal

%

Deployment Success Rate

+

Clients running on our solution

< 1s

Average Decision Time

%

of cases need human Intervention